Investing in today’s fast-paced financial world can be overwhelming, especially for beginners. With the rise of digital platforms, Wealthsimple has emerged as one of the most user-friendly and accessible investment platforms. Whether you are looking to get started with the stock market, planning for retirement, or searching for a money market account, Wealthsimple offers a solution tailored to your needs. This article will explore why Wealthsimple is a great choice for investors, how it compares to traditional financial advisors, and the tools available to help you make informed decisions.

Table of Contents

What is Wealthsimple?

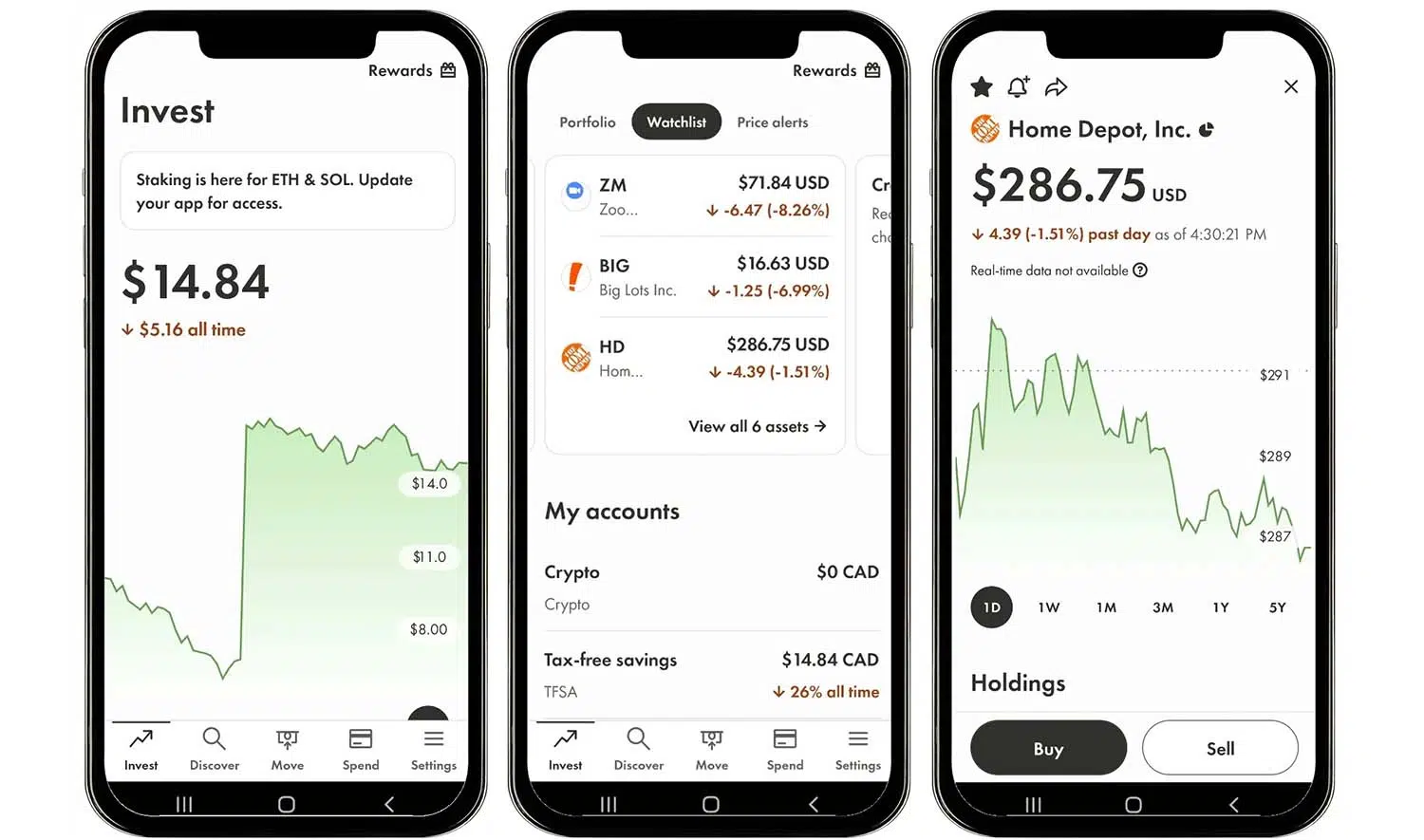

Wealthsimple is a Canadian-based online investment management service that provides automated and human-assisted investing options. Unlike traditional financial advisors, Wealthsimple offers an easy-to-use platform that allows users to invest in a diversified portfolio with low fees. Whether you are interested in stocks, ETFs, or cryptocurrency, Wealthsimple provides a seamless way to enter the stock market.

Key Features of Wealthsimple:

- Automated Investing: Uses advanced algorithms to optimize your portfolio.

- Low Fees: Competitive pricing compared to traditional financial advisors.

- Diverse Investment Options: Stocks, ETFs, cryptocurrency, and more.

- Access to Human Advisors: Get expert advice when needed.

- User-Friendly Interface: Simple and intuitive platform for all levels of investors.

Investing Made Simple

Investing does not have to be complicated. Wealthsimple’s robo-advisor model helps investors of all levels manage their money without requiring deep financial knowledge. The platform uses algorithms to allocate investments based on your financial goals and risk tolerance. This means you can start investing with minimal effort while ensuring your portfolio aligns with your long-term objectives.

The Benefits of Wealthsimple Investing:

- Low Fees: Traditional investment firms often charge high management fees. Wealthsimple offers competitive rates that help you save money over time.

- Diversification: Wealthsimple spreads your investments across multiple asset classes to reduce risk.

- Hands-off Approach: The automated system ensures your portfolio is managed efficiently without requiring constant monitoring.

- Financial Advisor Support: Although it operates mainly as a robo-advisor, Wealthsimple also provides access to human financial advisors for additional guidance.

Stock Market Access with Wealthsimple

For those looking to trade in the stock market, Wealthsimple provides a commission-free trading platform. This means you can buy and sell stocks without incurring additional costs, making it an excellent option for beginner investors or those looking to build their portfolio over time.

With access to major national stock exchanges, users can invest in companies they believe in and diversify their holdings. Unlike traditional brokerages that charge per trade, Wealthsimple’s commission-free structure allows investors to maximize their profits.

Features of Wealthsimple Trade:

- No Commission Fees: Buy and sell stocks without incurring extra costs.

- Fractional Shares: Invest in high-value stocks with as little as a few dollars.

- User-Friendly Interface: Easily track and manage your investments.

- Real-Time Data: Get instant access to stock market movements and trends.

- Secure Transactions: Industry-leading encryption and security protocols.

Retirement Planning with Wealthsimple

Planning for retirement is crucial, and Wealthsimple makes it easier with various retirement calculators and investment accounts. Whether you are considering an RRSP, TFSA, or another long-term investment option, Wealthsimple provides tools like an RRSP interest calculator to help you estimate your future savings.

Key Retirement Planning Features:

- RRSP & TFSA Accounts: Wealthsimple helps you grow your retirement savings with tax-advantaged accounts.

- Retirement Calculators: Use Wealthsimple’s retirement calculators to estimate how much you need to save for a comfortable retirement.

- Automated Contributions: Set up recurring deposits to ensure consistent growth in your retirement savings.

- Personalized Investment Plans: Receive tailored recommendations based on your retirement goals.

- Portfolio Rebalancing: Automatic adjustments to maintain an optimal investment mix.

Why an RRSP Interest Calculator Matters

Understanding how your money will grow is essential in retirement planning. Wealthsimple’s RRSP interest calculator helps you project your savings over time, factoring in contributions, expected returns, and inflation. This tool enables users to set realistic financial goals and adjust their savings strategy accordingly.

The Power of a Money Market Account

A money market account is an excellent way to earn interest while keeping your funds easily accessible. Wealthsimple offers a high-interest savings account that functions similarly to a money market account, providing competitive returns without locking in your money.

Benefits of a Money Market Account:

- Higher Interest Rates: Earn more compared to a standard savings account.

- Liquidity: Withdraw funds whenever needed without penalties.

- Security: Your funds are protected and insured, offering peace of mind.

- Automatic Transfers: Easily move money between investment and savings accounts.

- Ideal for Emergency Funds: A great place to store cash while earning interest.

How Wealthsimple Compares to Traditional Financial Advisors

Many investors struggle with whether to use a traditional financial advisor or an online platform like Wealthsimple. While financial advisors provide personalized advice, they often come with higher fees. Wealthsimple bridges this gap by offering a cost-effective, automated investment service with access to real advisors when needed.

Why Choose Wealthsimple Over a Traditional Financial Advisor?

- Lower Fees: Avoid the high management fees associated with traditional advisors.

- Accessibility: Invest anytime, anywhere through the mobile app or web platform.

- Data-Driven Decisions: Wealthsimple uses advanced algorithms to optimize your investment strategy.

- Scalable Capital: Whether you start with $100 or $10,000, Wealthsimple’s approach grows with you, making it ideal for both beginners and experienced investors.

- Human Support: Access real financial advisors when you need guidance.

Why Wealthsimple is a Scalable Capital Solution

Scalable capital is an important factor when choosing an investment platform. Whether you are starting with a small deposit or looking to expand your portfolio significantly, Wealthsimple provides a scalable solution that grows with your investment journey. The ability to start small and increase contributions over time makes Wealthsimple an attractive option for investors at any stage.

Scalable Investment Benefits:

- Start with Any Amount: No minimum balance required to begin investing.

- Automated Portfolio Adjustments: Wealthsimple adjusts your investments as your portfolio grows.

- Diversified Growth: Spread investments across different asset classes for stability and expansion.

- Tax-Efficient Strategies: Wealthsimple optimizes investments to minimize tax liability.

- AI-Driven Insights: Receive data-backed suggestions to improve your investment performance.

Final Thoughts: Is Wealthsimple Right for You?

Wealthsimple is a top choice for those looking to invest efficiently while keeping costs low. Whether you want to participate in the stock market, plan for retirement with an RRSP interest calculator, or explore the benefits of a money market account, this platform has something for everyone.

If you’re new to investing or looking for a smarter way to grow your wealth, Wealthsimple provides an intuitive and cost-effective solution. Ready to start your investment journey? Sign up today and take control of your financial future!